All Q3 payroll and tax information must be accurate and complete in isolved by Friday, Sept. 29, 2023, to ensure timely filing. Below are the recommended items to review to help you meet all requirements.

Review tax setup information

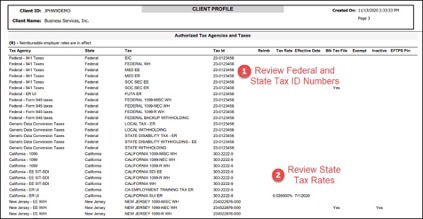

It is important you confirm that your company and tax setup is correct in isolved. Go to Reporting > Client Reports to run each report.

- Validate the company information below on the Client Profile Report.

- Name matches the legal company name registered with tax agencies

- FEIN matches the legal FEIN that is registered with tax agencies

- Address matches the legal company address registered with tax agencies

- Verify that a Tax Filing contact is listed and the contact information (name, email address and phone number) is correct and as it should be reflected on tax forms

- Validate your company tax information on the Client Profile Report under the section for Authorized Tax Agencies and Taxes.

- Review the federal and state tax ID numbers for accuracy

- Review the state filing frequencies and rates to ensure they are correct

Please remember tax agencies do NOT send any rate or filing frequency notices to Insperity, but they do send this information to you, the employer of record. If you have received these notices or see any discrepancies in your isolved setup, please forward all information to your payroll specialist.

You must have a registered ID number with all appropriate state and federal agencies in order to file. Agencies do not accept “Applied For” ID numbers for filing and payments. Submitting your filings with an “Applied For” ID could cause delay and agency penalties and fees.

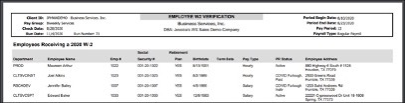

- Review employee information on the Employee W-2 Verification Report.

- Verify employee names and Social Security numbers for accuracy

- Verify employee names and Social Security numbers for accuracy

Other important tax reminders

- Third-quarter tax filings will be available on the Return Archive page of the Reporting menu in isolved on Nov. 1, 2023.

- Pay items that have not been entered in isolved yet OR payroll adjustments that will be reflected on Q2 returns MUST be reported to your payroll specialist by Friday, Sept. 29. These items include:

- In-house checks

- Voided checks

- Tax adjustments

- Third-party sick/disability payments

- Ensure all ARPA qualified sick and leave wages are entered correctly

- An additional charge will be applied for any Q3 corrections submitted after the Friday, Sept. 29, deadline.

Please contact your dedicated payroll specialist today if you have any questions or concerns regarding the information above.